Siam City Cement Public Company Limited (SCCC) recognizes the value of good governance and remains firmly committed to implementing and practicing good Corporate Governance (CG) across all its operations in pursuit of long term sustainable growth, adding value to all stakeholders.

The Board of Directors has prepared the Corporate Governance Policy as guidelines for the entire Group by adopting both principles and guidelines on Corporate Governance Code for Listed Companies 2017 of the Securities and Exchange Commission, Thailand (SEC). In particular, the Board of Directors delegated to the Governance Committee to conduct an annual review on the conformation of the Company’s corporate governance implementation with CG principles and guidelines of multiple governance bodies, such as the SEC, Thai Institute of Directors, and Thai Investors Association. The Governance Committee discussed and ensure that no issue that has impact on the Company’s corporate governance, and the Company has continuously improved the practices in governance and report the progress to the Board of Directors.

Overview of Corporate Governance of the Company

As a result of continuing and consistant adherence to good corporate governance policies, the Company remains its competitiveness, good performance, resilliency and status a good citizen for society, with continuing target to minimize environmental impact. In 2022, the Company received the following recognition for its corporate governance performance:

-

CGR at excellent level for 7th consecutive year by Thai Institute of Directors Association (IOD)

-

2021 ASEAN Corporate Governance Scorecard Award for ASEAN Asset Class PLCs (Thailand)

-

Full score (100) of the quality of the 2022 Annual General Meeting of Shareholders (AGM Checklist) as assessed by the Thai Investors Association.

-

Recertification as a member of the Thai Private Sector Collective Action Against Corruption (CAC) for a period of three years, from 30 June 2020 to 30 June 2023. Also, recertification is in progress.

-

Selected for the fourth year in a row as a company in the SET THSI Index, which is a responsible investment option.

-

Selected for the third year on the row as a company in the Thaipat Institute’s ESG 100 list, which is an option for investment in a listed company with outstanding ESG performance.

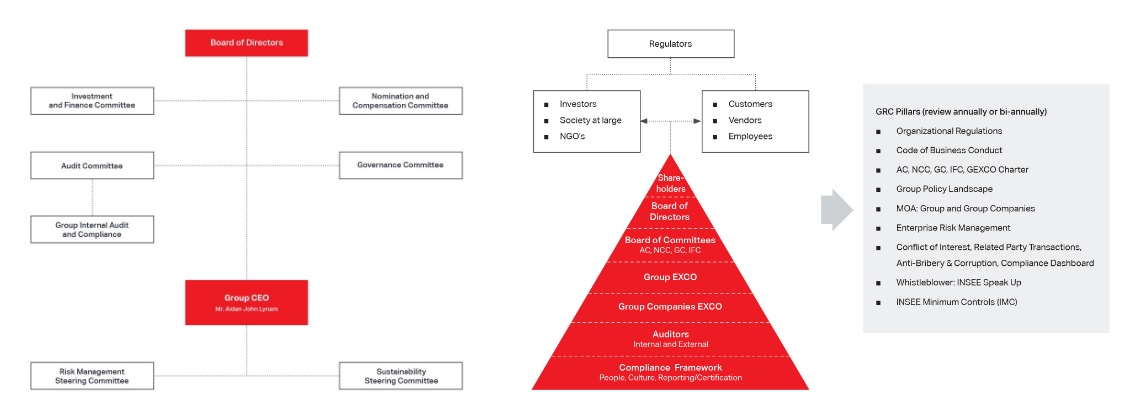

Overview of Corporate Governance of the Company

Corporate Governance structure of SCCC has a clear separation of roles, duties and responsibilities between the Board of Directors (the “Board”) and the Management providing the balance of power, independency, and transparent management which is auditable. To date, the organization chart of the corporate governance structure is the following:

Click here for more information

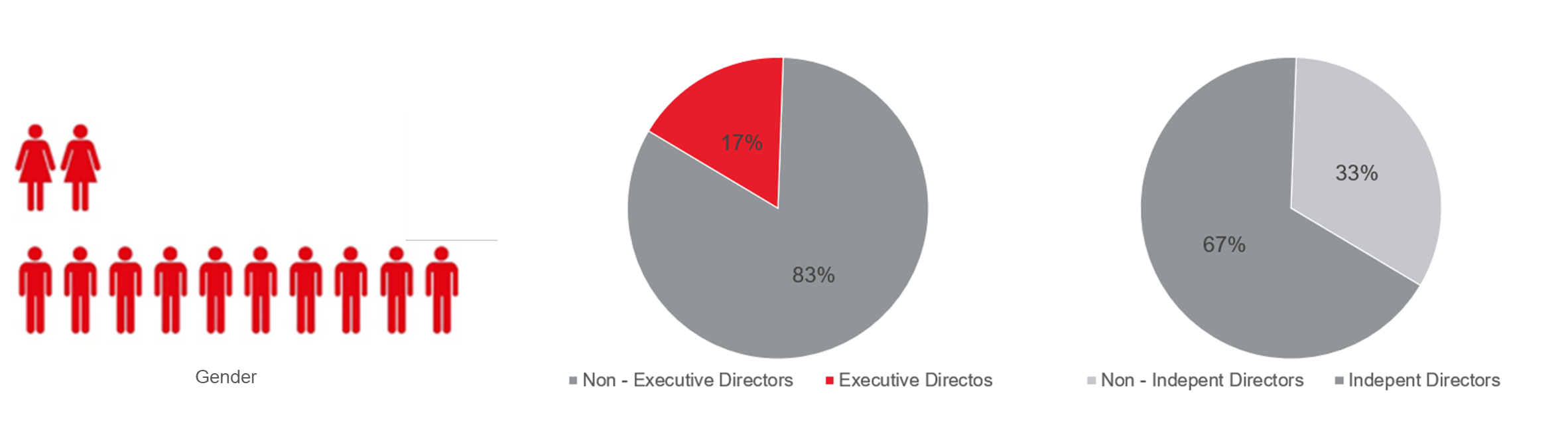

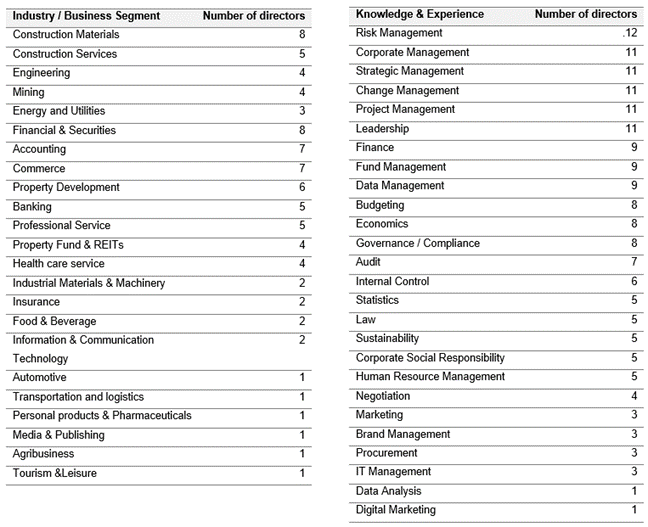

Board Composition

The Board consists of directors with qualifications, competencies, independence and diversity in age, gender, skills and experiences. The Board also has a proper proportion of independent directors, with number of non-executive directors more than half of the total Board members. The Board is of the opinion that its size and composition are suitable with the size, sector and complexity of the Business, as well as aligns with the principle of the good corporate governance. Board composition has evolved and is appropriate.

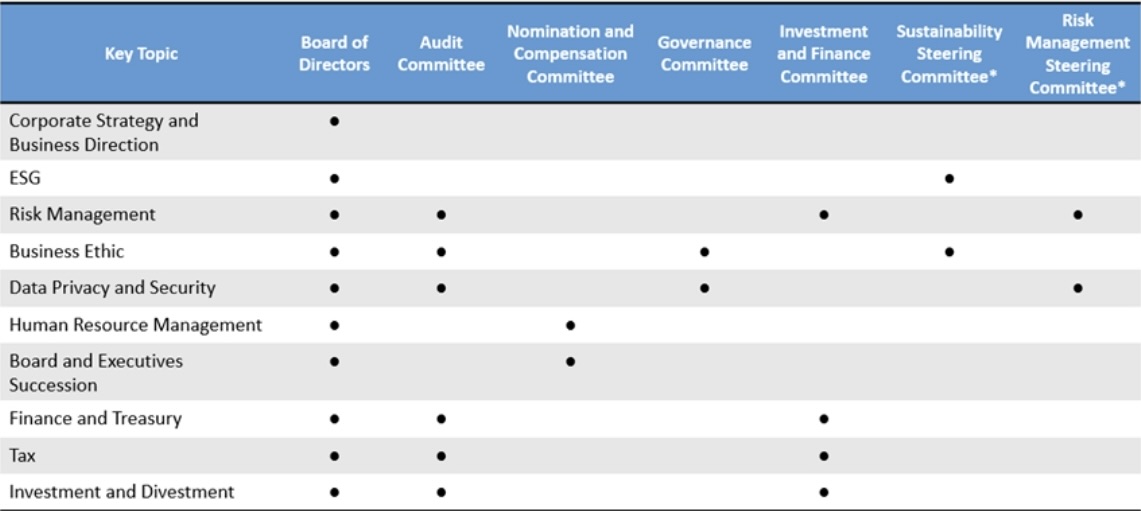

Board Committees

To ensure that the key business issues have been reviewed and considered thoroughly, the Board of Directors established the Board Committees to scrutinize the important agendas and enhance efficiency of the Board. Each Board Committee is governed by its charter which clearly defined its roles, duties, responsibilities, work procedures, and meeting and reporting requirements.

The Audit Committee (3 independent directors)

Assisting the Board in fulfilling its responsibility to the shareholders and the regulatory authorities relating to the (1) financial reporting processes to ensure the quality and integrity of the financial statements and reports of the Company, its subsidiaries, directly and indirectly held, and its associated companies (“Group”), (2) the internal control and internal audit systems and (3)review the Company’s compliance with the law on securities and exchange, the Exchange’s regulations, and the laws relating to the Company’s business

The Nomination and Compensation Committee

Overseeing the policies and procedures related to the recruitment, nominationand compensation for members of the Board and the executive management of the Company in particular, and the overall compensation policies and programsas relevant and applicable for the Company, its subsidiaries, directly and indirectly held, and its associated companies (“Group”), and to make recommendations to the Board with respect to such policies and program in order to promote the Group’s aspiration to become the Employer of Choice in all its businesses.

The Governance Committee

Overseeing the Company’s policies and frameworks related to corporate governance for the Company and its subsidiaries and to make recommendations to the Board with respect to such policies and frameworks to protect the reputation and interests of the Group.

Investment and Finance Committee

Assisting and advising the Board in all matters related to (1) investments, divestments, and capital projects as well as the financing of such activities, (2) the structuring of the balance sheets at both parent and operating companies’ levels including related financial management matters, and (3) Group policies and directives related to the above.