Siam City Cement Public Company Limited (SCCC) recognizes the value of good governance and remains firmly committed to implementing and practicing good Corporate Governance (CG) across all its operations in pursuit of long term sustainable growth, adding value to all stakeholders.

The Board of Directors has prepared the Corporate Governance Policy as guidelines for the entire Group by adopting both principles and guidelines on Corporate Governance Code for Listed Companies 2017 of the Securities and Exchange Commission, Thailand (SEC). In particular, the Board of Directors delegated to the Governance Committee to conduct an annual review on the conformation of the Company’s corporate governance implementation with CG principles and guidelines of multiple governance bodies, such as the SEC, Thai Institute of Directors, and Thai Investors Association. The Governance Committee discussed and ensure that no issue that has impact on the Company’s corporate governance, and the Company has continuously improved the practices in governance and report the progress to the Board of Directors.

Overview of Corporate Governance of the Company

As a result of continuing and consistant adherence to good corporate governance policies, the Company remains its competitiveness, good performance, resilliency and status a good citizen for society, with continuing target to minimize environmental impact. In 2024, the Company received the following recognition for its corporate governance performance:

- SET ESG Ratings of “AA” for the 2nd Consecutive Year

- 2021 ASEAN Corporate Governance Scorecard Award for ASEAN Asset Class PLCs (Thailand), received 2022, with latest assessment in 2024 (result disclosed later in 2025)

- Certification as a member of the Private Sector Collective Action Against Corruption (CAC) since 2017

- ESG100 - List of Excellent Performance in Sustainable Development for the 4th Year

Overview of Corporate Governance of the Company

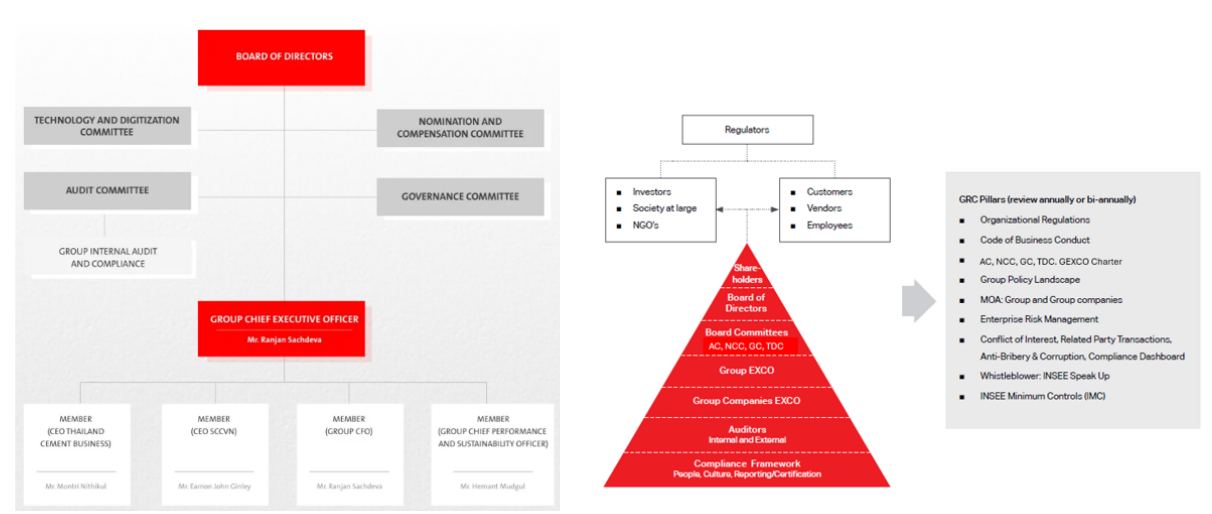

Corporate Governance structure of SCCC has a clear separation of roles, duties and responsibilities between the Board of Directors (the “Board”) and the Management providing the balance of power, independency, and transparent management which is auditable. To date, the organization chart of the corporate governance structure is the following:

Click here for more information

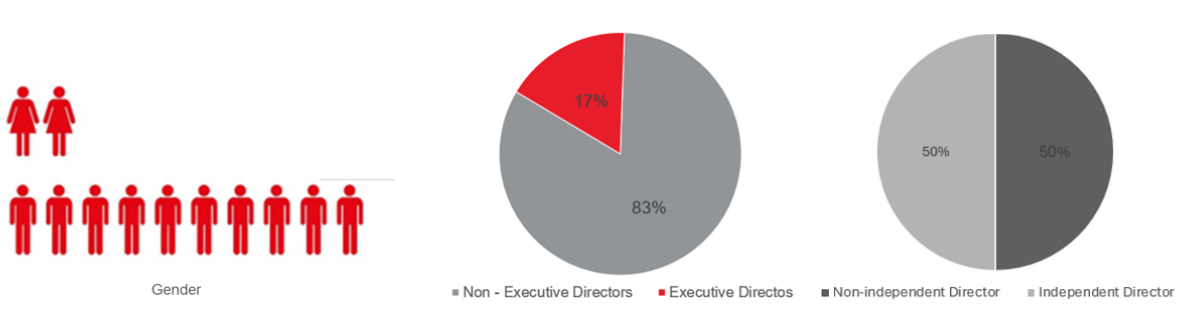

Board Composition

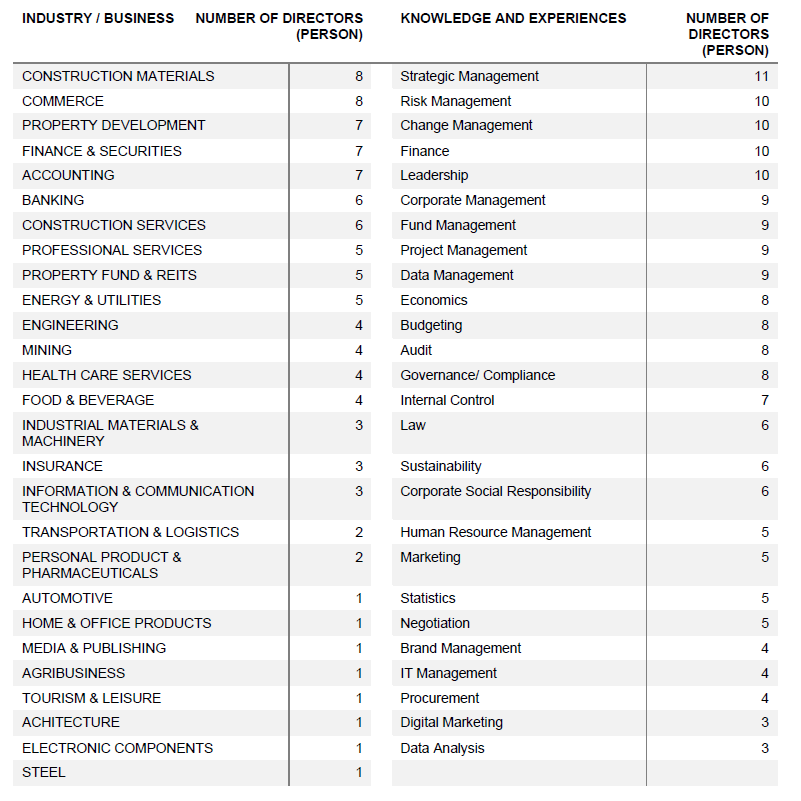

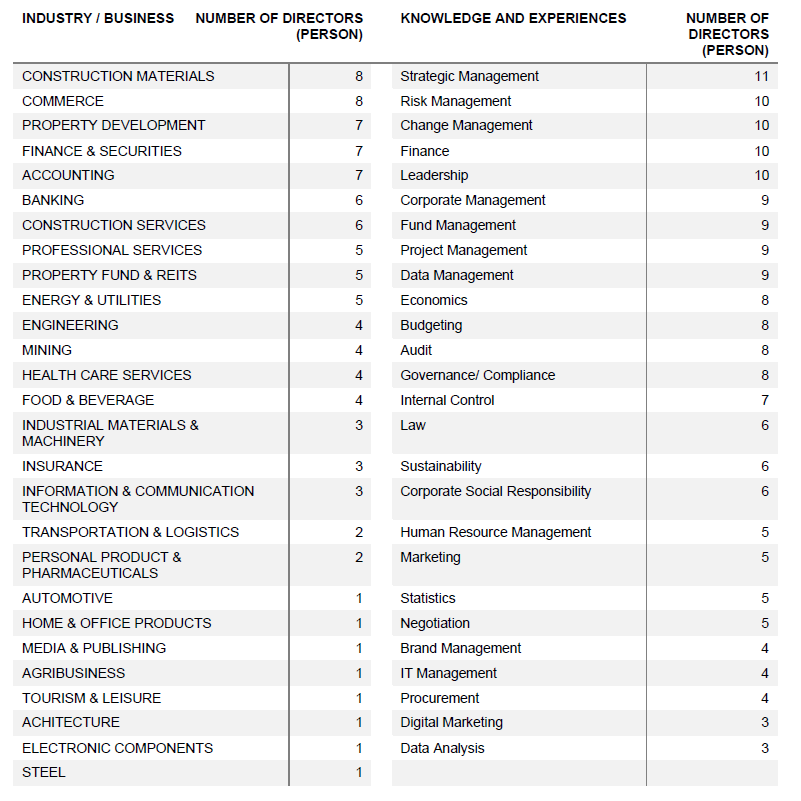

The Board consists of directors with qualifications, competencies, independence and diversity in age, gender, skills and experiences. The Board also has a proper proportion of independent directors, with number of non-executive directors more than half of the total Board members. The Board is of the opinion that its size and composition are suitable with the size, sector and complexity of the Business, as well as aligns with the principle of the good corporate governance. Board composition has evolved and is appropriate.

Board Committees

To ensure that the key business issues have been reviewed and considered thoroughly, the Board of Directors established the Board Committees to scrutinize the important agendas and enhance efficiency of the Board. Each Board Committee is governed by its charter which clearly defined its roles, duties, responsibilities, work procedures, and meeting and reporting requirements.

The Audit Committee (3 independent directors)

Assisting the Board in fulfilling its responsibility to the shareholders and the regulatory authorities relating to the (1) financial reporting processes to ensure the quality and integrity of the financial statements and reports of the Company, its subsidiaries, directly and indirectly held, and its associated companies (“Group”), (2) the internal control and internal audit systems and (3)review the Company’s compliance with the law on securities and exchange, the Exchange’s regulations, and the laws relating to the Company’s business

The Nomination and Compensation Committee

Overseeing the policies and procedures related to the recruitment, nominationand compensation for members of the Board and the executive management of the Company in particular, and the overall compensation policies and programsas relevant and applicable for the Company, its subsidiaries, directly and indirectly held, and its associated companies (“Group”), and to make recommendations to the Board with respect to such policies and program in order to promote the Group’s aspiration to become the Employer of Choice in all its businesses.

The Governance Committee

Overseeing the Company’s policies and frameworks related to corporate governance for the Company and its subsidiaries and to make recommendations to the Board with respect to such policies and frameworks to protect the reputation and interests of the Group.

The Technology and Digitization Committee

Overseeing and guiding the formulation of a strategic roadmap and execution aimed at transforming the Company's operations through appropriate and fit for purpose technologies and digital innovations

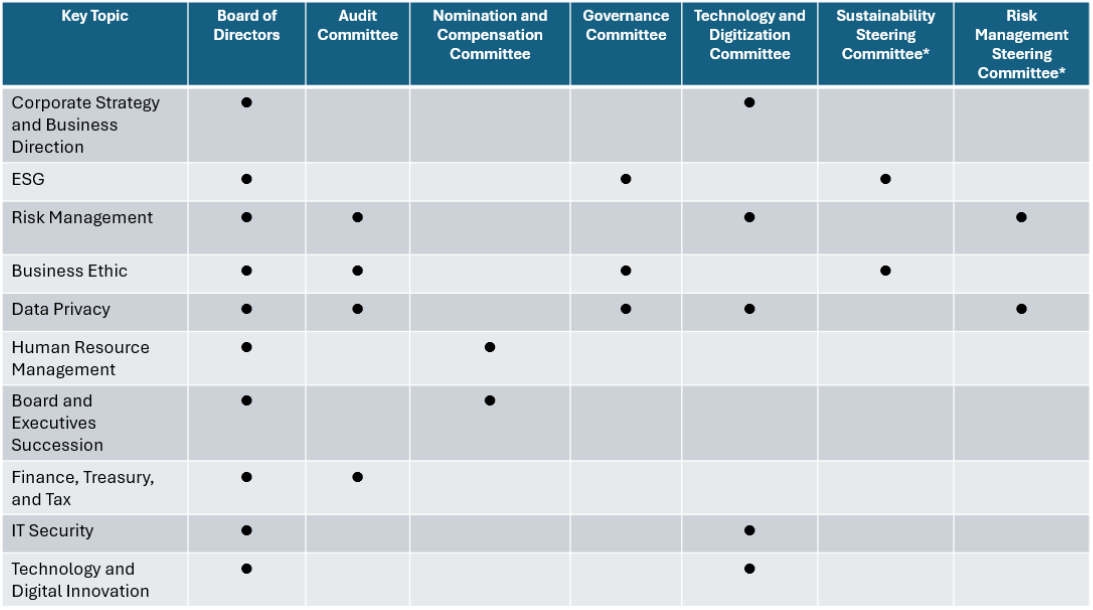

Governance Activites of the Board of Directors and the Sub-committes

Remark: * Management-level committee which is chaired by the assigned director from the Board of Directors.

Remunerations for the Board of Directors

The Board of Directors has charged the Nomination and Remuneration Committee with considering the criteria for determining the remuneration of the Board of Directors and sub-committees in a transparent process, taking into account the suitability and responsibilities of the position, as well as other factors such as the company's business and operating results, norms in the same market and industry, economic conditions, and other facts, which are compared to industry standards, then, submit an opinion to the Board of Directors for consideration and screening, followed by a proposal to the shareholders for approval.

Remunerations of Executive Directors and Executives

The remunerations of the Executive Directors and the Executives are competitive among the leading cement manufactures and is approved by the Board of Directors on recommendation of NCC.

The short-term performance such as the annual performance bonus is based upon the achievement of KPIs that are objective and aligned with the business performance and leadership competencies are combined with long-term performance, such as the Executive Entitlement Program to Purchase Company Securities for Corporate Engagement (EJIP).

Compensation policies and incentive programs of the Group are under the direction and guideline of the Nomination and Compensation Committee (the NCC), as explicitly delegated by the Board.